Deutsche Bank ‘bad bank’ not enough to address brand equity

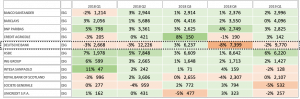

Deutsche Bank underperforming in ESG in 4 out of 5 quarters

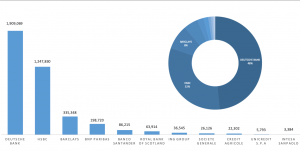

In total, 4.5 million posts about 11 banks were harvested and analysed for sentiment, topics, brands, and noise (irrelevant posts) with high accuracy, using proprietary machine learning models. The 11 banks included in the report are: Deutsche Bank, HSBC, Barclays, BNP Paribas, Banco Santander, Royal Bank of Scotland, ING Group, Société Générale, Credit Agricole, UniCredit S.p.A, and Intesa Sanpaolo.

Despite having the biggest share of voice, Deutsche Bank is underperforming in ESG (Environmental, Social, Governance), with news on governance in particular being the driving force behind negative sentiment about the bank. On the topic of ESG, Deutsche Bank has negative Net Sentiment Score™ (NSS™) in four out of five quarters. NSS™ in the social intelligence world mirrors the well known Net Promoter Score (NPS) from surveys.

Further to that, Trump suing the bank at the end of April has not helped. In a single day between April 29-30th the number of negative posts jumped 10X to over 100,000. An early but very interesting finding by the DigitalMR data scientists is that negative ESG posts about DB were found to have high negative correlation with Deutsche Bank’s valuation based on its daily stock price! The June 17th article by FT reports that Deutsche Bank will be creating a bad bank that will take all the bad loans, but that will only address the balance sheet issues of the bank, not their brand equity.

Further research is on the way to find more proof whether buzz about the Governance of a bank can be predictive of its main stock price. For more findings from the report, contact DigitalMR.

DigitalMR is a London based technology company with proprietary solutions for social intelligence (listening & analytics) - listening247, and DIY private online communities - communities247. It specialises in the use of Artificial Intelligence for high accuracy text and image analytics and the integration of Social, Survey, and Sales data for unique actionable insights that could not otherwise be obtained. listening247 was developed specifically for market research, offering the highest possible sentiment and semantic (topics) accuracy in any language. It can be used to analyse data on any topic or product category, from any country around the world, on all social media and other online sources such as blogs, forums, news and reviews. DigitalMR has a variety of current and past clients and partners, and works with multinationals in various sectors such as FMCG, retail, banking & finance, telecoms, and NGOs.

Sophia Papagregoriou

DigitalMR

+44 20 3176 6800

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.