ASX closes higher after unemployment rate rises, markets pare back bets of a super-sized interest rate cut — as it happened

The ASX ended the day on a high after maintaining earlier gains following a small jump in the jobless rate.

The latest labour force data showed the number of people employed increased by 32,000 in March but the unemployment rate edged higher, with the numbers closely watched by forecasters ahead of the RBA's May meeting.

Wall Street closed lower, after concerns about tariffs were aired by the US central bank's chair and by chip maker Nvidia.

See how the day unfolded from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.8% at 8021

- Australian dollar: -0.5% to 63.36 US cents

- Wall Street: Dow -1.7% S&P -2.2% Nasdaq -3.1%

- Europe: Stoxx600 -0.2% DAX +0.3%

- Spot gold: -0.4% % to $US3,331/ounce

- Brent crude: +0.8% to $US66.42/barrel

- Iron ore: -0.7% at $US98.05/tonne

- Bitcoin: +0.4% to $US84,607

Prices current around 4:35pm AEST.

Live updates on the major ASX indices:

Share market closes higher

The Australian share market has ended the day higher after maintaining its gains after the release of monthly jobs data.

The unemployment rate rose slightly from 4 to 4.1% in seasonally adjusted terms, though BDO Economics Partner Anders Magnusson said the figures weren't likely to influence the next RBA rates call.

The All Ordinaries was up 0.8% to 8021 and the ASX 200 closed +0.8% to 7819.

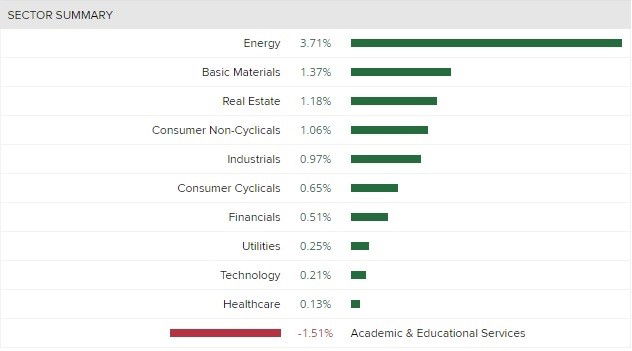

By the end of the day all sectors had made gains except academic, which has been in the red all day.

The Australian dollar is 0.4% lower at 63.42 US cents.

At 2:25pm AEST US futures for their Thursday trading day were all pointing up.

Have a good weekend / Easter break

LoadingThe democratic contradiction

It’s strange stuff really. One country and its President ( elected) has chosen a path for his country and the world goes nuts. The Democratic Party in the USA can not understand how it was that they lost and continue to scream about it. The people voted them out. It looks like the Democratic Party does not think that the people can be trusted with such a decision. If I’m correct then the USA is in deep trouble along with the world. Their democracy is on thin ice.

- Clive Nicholson

Hi Clive,

That's a funny way of putting it, i.e. to criticise people who think "the people can't be trusted" in a democracy.

That was one of the inherent weaknesses with democracies, as Plato identified in The Republic, in that people often don't make rational choices, and they often make choices that undermine their own self-interest.

That contradiction has been there from the beginning for democratic societies. We've just learned to live with it.

It's worth re-reading his section on "imperfect societies," by the way. He details how democracies can disintegrate into tyrannies when disputes between rival factions lead to such severe political nastiness that people turn to a "single popular leader" in desperation.

He warns if that popular leader is exiled for a time, but then returns in spite of his enemies, he will "return a finished tyrant."

Does today's jobs data change the RBA's focus?

EY Senior Economist Paula Gadsby says today's data shows the labour market remains tight:

"Although headline inflation has fallen into the target band, the minutes from the Reserve Bank’s April meeting noted that the tight labour market, strong growth in unit labour costs and lagging productivity growth remain upside risks to inflation remaining low.

Notwithstanding these risks, a 25-basis point cut in interest rates at the May Reserve Bank meeting seems likely.

Since the last meeting, there have been minimal new upside pressures on inflation, while global trade developments tilt the balance of risks for growth to the downside, especially if there is a “nervous pause” in business and consumer activity. However, depending on how events unfold, there could also be potential upside risks to the outlook for economic activity and inflation. Further important data releases before the May meeting, especially consumer and business confidence data, and the March quarter CPI, will assist the Reserve Bank to refine its view over the coming weeks. "

We can't measure everything in dollars

Trump has closed off the 'de minimis' loophole; it's also worth mentioning that Hong Kong has stopped sending parcels to the US altogether. (As someone who just spent $13.55 sending 5 teabags to my bestie in the US, I kind of wish AusPost would do the same - it'd give me a nice excuse to stop spending a fortune sending my friends and family things of minimal worth!)

- Plain Jane

Thanks Jane.

Or look at it another way. The smile on your besties' face when they open the parcel and see the tea bags? Priceless.

These small acts of love are very valuable in 2025.

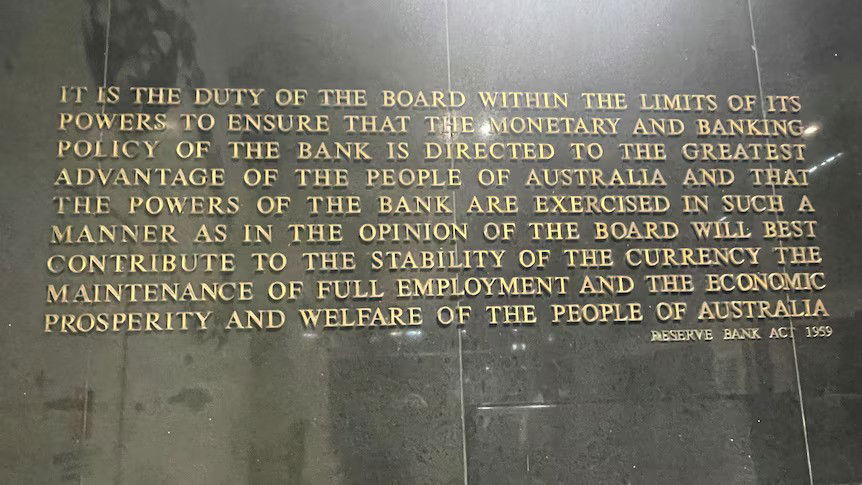

The RBA's goals and obligations

So, looking at the rise in unemployment, I seem to recall that the Federal Reserve in the US is required (? or maybe just aims to) *both* maximise employment and maintain stable prices (or something like that). But, if I recall correctly, the RBA is only required to manage inflation (and seems to be of the opinion that boosting unemployment is a good method of achieving that goal, thanks Prof. Phillips). Did Scrooge chase everyone who needs to work for a living out of the room when the legislation regulating the RBA was being written, or what's the story there?

- Stephen

Hi Stephen,

According to the RBA Act 1959, the Reserve Bank was responsible for three main things:

- The stability of the currency

- The maintenance of full employment, and

- The economic prosperity and welfare of Australians

That triple mandate adapted itself to big changes in the global economy over the decades.

In 1959, under the Bretton Woods system, when Australia's currency was pegged to the British pound, the "stability of the currency" and "full employment" meant very different things.

We ended up abandoning that old definition of "full employment" in the 1970s and we floated the dollar in 1983.

From thereafter, "full employment" came to be defined as the lowest level of unemployment that was thought to sustainable with low levels of inflation (i.e. which wouldn't contribute to accelerating inflation) through the cycle.

And in a world of floating exchange rates, the "stability of the currency" was going to be best supported by maintaining a low and stable level of inflation.

Over time, however, it seemed as though economic authorities started to put more emphasis on targeting inflation.

That's why the 2023 Review of the RBA recommended that more equal emphasis should be placed on low and stable inflation and full employment.

That's why you may have noticed a slight change in the RBA's communications in recent years, whereby it's now regularly mentioning its "dual mandate" of low inflation and full employment.

During the debates leading up to that RBA review, it was argued that the third goal of monetary policy that was mentioned in the RBA Act 1959 - that the RBA should aim to improve the economic prosperity and welfare of Australians - was self-evident and didn't need to be explicitly stated.

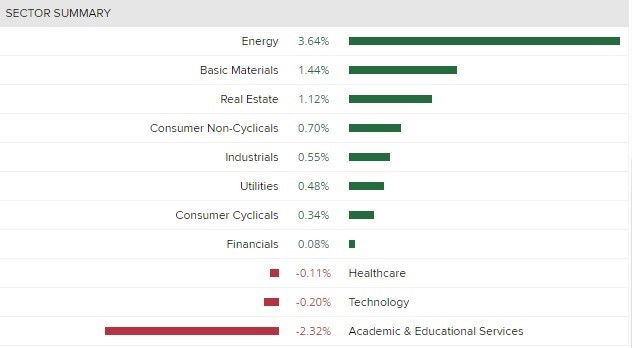

ASX maintains gains in mid afternoon trade

The Australian share market has extended its gains, with the ASX 200 and the All Ordinaries up 0.6% at 2:50pm AEST.

Gold miners and energy companies were among the biggest gainers, with the energy sector the best performing and academic the worst sector:

Tariffs will have more influence on rates than jobs data: HSBC

Data from today indicates the job market may be tightening, says Paul Bloxham, HSBC's Chief Economist for Australia, NZ + Global commodities:

"There would be nothing in this report to suggest the jobs market would be a reason why the RBA should be cutting its cash rate further.

However, local events are being overtaken by global ones. The global trade policy shock has seen our economics team downgrade its global growth forecasts. We have also nudged our growth forecasts lower for Australia and expect GDP growth of 1.6% in 2025 and 2.0% in 2026.

For monetary policy though, we see the bigger effect as whatever the likely impact on local inflation will be from these developments. On this, we see the global slowdown as likely to be disinflationary and expect that Australia will also see lower imported goods prices due to trade diversion. If China is unable to export as many manufactured goods to the US, we expect some these to head towards Australia's market, putting downward pressure on imports goods prices.

This disinflationary effect should allow the RBA to cut its cash rate further, despite the economy operating at close to full employment and many domestic price pressures persisting. However, these domestic price pressures are why we expect the RBA to take a cautious approach to easing.

Our central case sees the RBA lowering its cash rate by 25bp in May and by another 75bp by Q1 2026, taking the cash rate to 3.10% by early 2026 (we revised our cash rate view just after the US 'liberation day' tariffs announcements)."

With the high cost of housing, the appeal of co-ops grows

With the affordability of housing a major financial stress point for many, some people are looking at alternative models.

One of them is housing co-operatives: a community-led form of affordable housing run by the people who live in them.

Residents can be renters or they can have a stake in the co-operative's equity, and advocates say they could be part of the solution to Australia's rental crisis.

Read more by Danielle Pope:

The mystery of the missing workforce

Employment growth has slowed over the past year, so why hasn't Australia's unemployment rate increased?

Our resident data expert Gareth Hutchens answers this question and more in this comprehensive article on today's figures:

Global uncertainty already affecting hiring: recruiter

While Australia's jobs market remained broadly steady last month, recruiters have told The Business the global uncertainty spurred by the Trump administration's trade war is starting to have an impact on hiring.

"The uncertainty that's happening globally is affecting people willing to invest in new jobs and new hires," Kris Viner from recruitment agency Robert Walters said.

"With the news cycle and the unpredictability around tariffs kind of changing every week, you'd be very brave to make large-scale hiring investments until you really understand how that's going to affect you."

You can catch a report on the jobs market and the hiring environment from Rhiana Whitson on The Business tonight at 8:45pm AEST on ABC News Channel and anytime on iView.

While employment increased by 32,000 in the month of March, economists say Australia's job market has cooled down noticeably in recent months, with far fewer jobs being added compared to this time last year.

Read more here from business reporter Gareth Hutchens:

Jobs data sets us up for a rate cut: AMP economist

Today's unemployment figures were a solid set of numbers that shows the labour market is holding up well, according to AMP's Chief Economist Diana Mousina.

Ms Mousina said although the rise in employment was slightly below economist expectations, volatility in the figures means it could still be considered a good outcome.

She also noted that hours worked fell by 0.4% because of more people than usual reducing hours in the wake of bad weather in NSW and QLD thanks to Cyclone Alfred.

What does it mean for interest rates?

While there has been different commentary around this today, Diana Mousina reckons it's fairly positive, with the labour market in good shape:

"The unemployment is likely to increase a tad further, peaking at around 4.3% which should ease the pace of wages growth further. The RBA see the unemployment rate reaching 4.25% by June and remaining at that level"

"From an interest rate point of view, this is the perfect set-up for the RBA – lower inflation but the labour market holding up. While the unemployment rate remains low, the slowing in wages (and therefore inflation) makes us confident that the strength in the labour market should not deter further rate cuts. We see another 0.25% rate cut in May, after the March quarter inflation data which should show a quarterly trimmed mean of 0.6% (lower than RBA forecasts of 0.7%). And then we expect another 0.25% cut in August. Our view has not changed since the new US tariff announcements because the impact on Australia is unclear. Exports to the US may slow but they only account for <5% of total goods exports."

She concludes by saying:

"So, there is certainly no need for the RBA to press the panic button right now with a large interest rate cut at the next Board meeting"

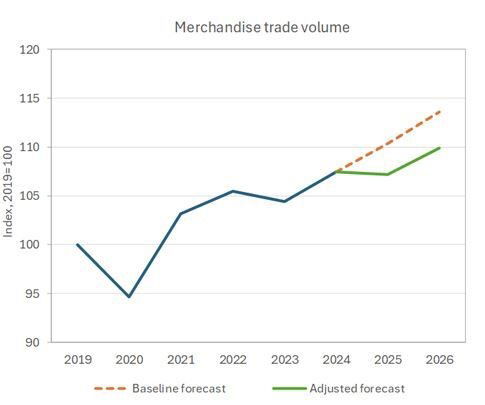

WTO sees world trade -0.2% this year, with a US export slump

Hi team,

Just jumping in with a deeper look at something flagged earlier on the blog, the World Trade Organisation's 'Global Trade Outlook and Statistics'.

Aware that, with that title, it's not exactly a new Jack Reacher novel, but it's still worth your time.

Here are the key points:

- Under current conditions, the volume of world merchandise trade is likely to fall by -0.2% in 2025. The decline is expected to be particularly steep in North America, where exports are forecasted to drop by -12.6%.

- However, severe downside risks exist, including the application of “reciprocal” tariffs and broader spillover of policy uncertainty, which could lead to an even sharper decline of -1.5% in global goods trade and hurt export-oriented least-developed countries.

- The report contains for the first time a forecast for services trade to complement its projections for merchandise trade. The volume of services trade is forecasted to grow by +4.0% in 2025, around 1 percentage point less than expected.

Markets pare back bets of a super-sized rate cut

A quick check in on what's happened to interest rate cut expectations following the jobs figures.

Market pricing for a 50 basis point cut in May has pared back — from 30 per cent earlier, to around 22 per cent, according to LSEG Refinitiv.

But consensus remains that there will be a decrease in the cash rate of some size when the RBA board next meets.

Market snapshot

- ASX 200: +0.4% at 7993

- Australian dollar: -0.2% to 63.58 US cents

- Wall Street: Dow -1.7% S&P -2.2% Nasdaq -3.1%

- Europe: Stoxx600 -0.2% DAX +0.3%

- Spot gold: -0.2% % to $US3,337/ounce

- Brent crude: +0.7% to $US66.25/barrel

- Iron ore: -0.7% at $US98.05/tonne

- Bitcoin: +0.7% to $US84,647

Prices current around 12:30pm AEST.

Live updates on the major ASX indices:

Unemployment would be 4.7 per cent if participation hadn't declined

Some interesting observations, as usual, from job website Indeed's Asia-Pacific economist Callam Pickering:

"While employment rose by 32,200 people in March, that followed a decline of 57,500 people in February. In fact, over the first three months of the year, Australian employment has increased by just 6,500 people. That's a fair slowdown from last year when the job market was regularly adding 100,000 people or more a quarter.

"Given that, it's perhaps surprising that Australia's unemployment rate hasn't increased. The reason though is quite simple: Australia's participation rate has declined by 0.5 percentage points over the past two months, effectively absorbing the impact of low employment growth. If the participation rate had held steady, at its record high from January, Australia's unemployment rate would have jumped to 4.7%."

The big decline in the participation rate came in last month's February data release, and the ABS mostly attributed it to a larger cohort of people retiring.

ASX higher after steady jobs data

The Australian share market is trading a little higher at lunch time, driven by mining and energy stocks.

The All Ords are 0.43% higher to 7996 points, while the ASX200 is up 0.48% to 7795 at 12:20pm AEST.

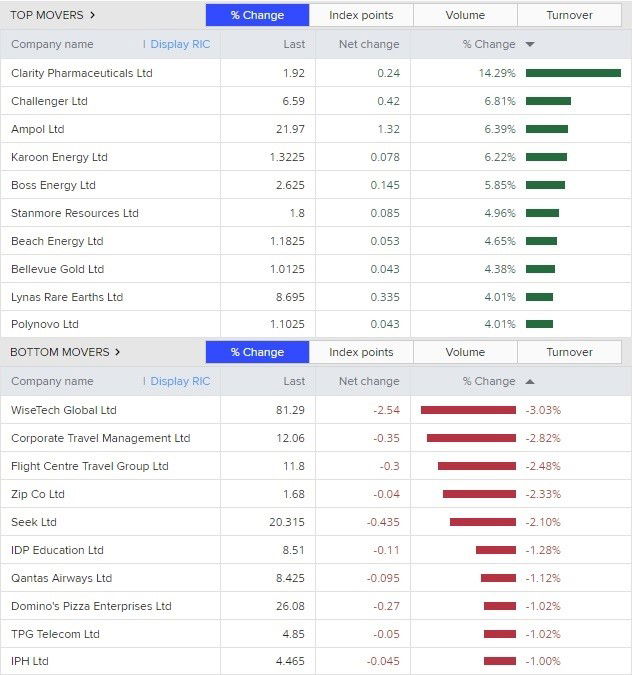

The top movers are mostly energy and resources companies, except for Clarity Pharmaceuticals which is leading the way after it announced it was signing a commercial-scale supply agreement for copper-64 isotopes - something used in cancer diagnosis and therapy.

WiseTech is leading the losses, along with some travel and tech stocks.

The Australian dollar is down to 63.56 US cents.

Update

Why all 4 big banks cutting rates when they know that with Volatility in stocks and unemployment no at 4.1% Reserve will not cut as unfair during elections one party gets undue advantage

- Abbas

Hi Abbas, the banks cut rates following the RBA's decision in February to do so. The central bank did not cut rates at its last meeting earlier this month. Its next meeting in late May will fall after the federal election. It remains to be seen what they will do then, but markets are predicting they will cut rates then

Labour market 'resilient': NAB economist

The jobs data shows the labour market is still strong thanks to population growth and "healthy" labour demand.

That's according to NAB economist Gareth Spence, who spoke to Finance presenter Sam Yang a few minutes ago:

Loading...Hours worked fell amid ex-Tropical Cyclone Alfred

Hours worked over the month of March decreased by 0.3 per cent, according to the ABS data.

It's the second monthly decline in a row, even though employment increased in March.

"A higher than usual number of people reported working reduced hours this month due to bad weather, coinciding with ex-Tropical Cyclone Alfred and other major weather events in New South Wales and Queensland," ABS head of labour statistics Sean Crick noted.