The euro surged to a nearly five-month high against the US dollar following Trump’s tariff announcement. The greenback weakened against most other currencies as US government bond yields slumped on a deteriorating economic outlook. Meanwhile, the reciprocal tariffs rattled global markets.

The euro surged against the US dollar following US President Donald Trump’s reciprocal tariff announcement on Wednesday night. The EUR/USD pair jumped 0.5%, or more than half of a US cent, to 1.0915 at 5:17 am, nearing a five-month high of 1.0953. The level almost recovered all the losses since Trump was re-elected on 5 November.

The US president said his administration would impose a minimum 10% tariff on all countries and additional levies on nations considered offenders. He displayed a chart listing the countries subject to higher tariffs, with China, the European Union, and Vietnam as the top three, facing rates of 34%, 20%, and 46%, respectively. The additional rate will push import duties on China to 54% on top of the existing 20% blanket tariffs.

The US dollar weakened broadly against most other major currencies, particularly the Japanese yen, the euro, the British pound, and the Swiss franc, as traders anticipated economic backlash to the US, with 10-year US Treasury yields plunging to their lowest level since October 2024.

However, commodity currencies, particularly the Australian dollar and the Canadian dollar, weakened against the greenback. These currencies are tied to global commodity prices, such as copper and crude oil, which saw sharp declines during Thursday’s Asian session. The sweeping reciprocal tariffs sparked fears of an all-out global trade war, raising concerns about a sharp economic downturn and even a broader recession, which, in turn, weakened industrial metal and energy demand outlooks.

Global stock markets tumble

The announcement spooked global markets, sending stock markets tumbling across Asia on Thursday. The Japanese stock market led broad losses, with its benchmark Nikkei 225 falling nearly 3% during the session, followed by China’s Hang Seng Index, sliding 1.5%, while Australia’s ASX 200 and South Korea’s Kospi were down 1%.

Notably, big miners’ stocks led the broad losses in the Australian equity market, with BHP down 2.4% and Rio Tinto slumping 2.8%. The drop in copper heavily weighed on regional markets, with the impact likely spilling into the UK’s equities due to the dual-listed nature.

“While Australia’s direct trade exposure to the US is minimal, the knock-on effects via China and broader Asian nations that have seen hefty tariffs could weigh on our export-heavy economy, especially if global demand slows and commodity prices retreat,” Josh Gilbert, a market analyst at eToro, wrote in a note.

US stock futures plunged, with the Dow Jones Industrial Average falling 2.01%, the S&P 500 slumping 2.78%, and the Nasdaq declining 3.3%, pointing to a sharply lower open on Thursday. The selloffs are set to ripple through European markets today, as Germany’s DAX futures had already dropped 1.89% at 5:30 am Central European Time.

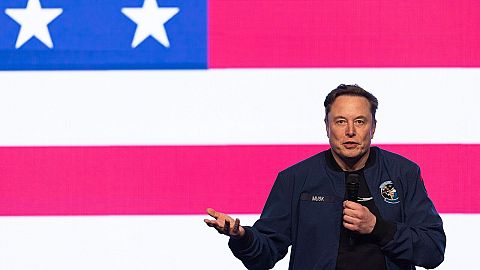

Technology stocks are set to plunge, as indicated by the extended trading session on Wall Street. The Magnificent Seven stocks all declined significantly in after-hours trading, with Tesla’s shares slumping 4.5%, Apple down 2.3%, and Nvidia sliding 2.4%. “There is clearly going to be an impact that weighs on these tech titans, especially when you consider Apple’s heavy exposure to China and Nvidia’s reliance on Taiwan,” Gilbert added.

Gold surges to a new high

Risk-off sentiment sent gold prices surging to a new all-time high, with gold futures jumping to $3,195 per ounce at COMEX and spot gold rising to as high as $3,167 per ounce before retreating.

Uncertainties will remain, which could provide further upside potential for the yellow metal. “There was no clear indication that the Trump administration will stop here with 'trade wars.’ That could mean further uncertainty,” said Kyle Rodda, a senior market analyst at Capital.com.

Gold, seen as a typical haven asset, rose 20% this year, following a 30% rally in 2024, making it one of the best performers among asset classes. Central banks’ increased purchasing, suspicion of a debasement in the US dollar, and investors’ hedging positions all contributed to the precious metal’s price surge in recent years.