(Wednesday Market Open) Things are moving quickly this morning as investors get a first look at prepared congressional testimony from Fed Chair Jerome Powell. It looks like he’s leaning toward a dovish take on the economy, and that could help give stocks an early boost.

Hours before he started his testimony, Powell’s prepared remarks came out. The crux of his message was that the economy hasn’t improved in recent weeks. He cited concerns about trade issues and slowing global economies, as well as inflation that’s still muted and which he worries could last longer. He also mentioned slow business investment. The market seems to be interpreting this as an indication that the Fed is ready to cut rates.

The inflation part is particularly interesting because Powell has often said he sees low inflation as a short-term issue. Now he’s talking about the chance of it remaining “persistent,” which would probably give the Fed a bit more leeway to keep rates lower. Fed funds futures moved quickly when the testimony came out, with chances of a second hike in September rising.

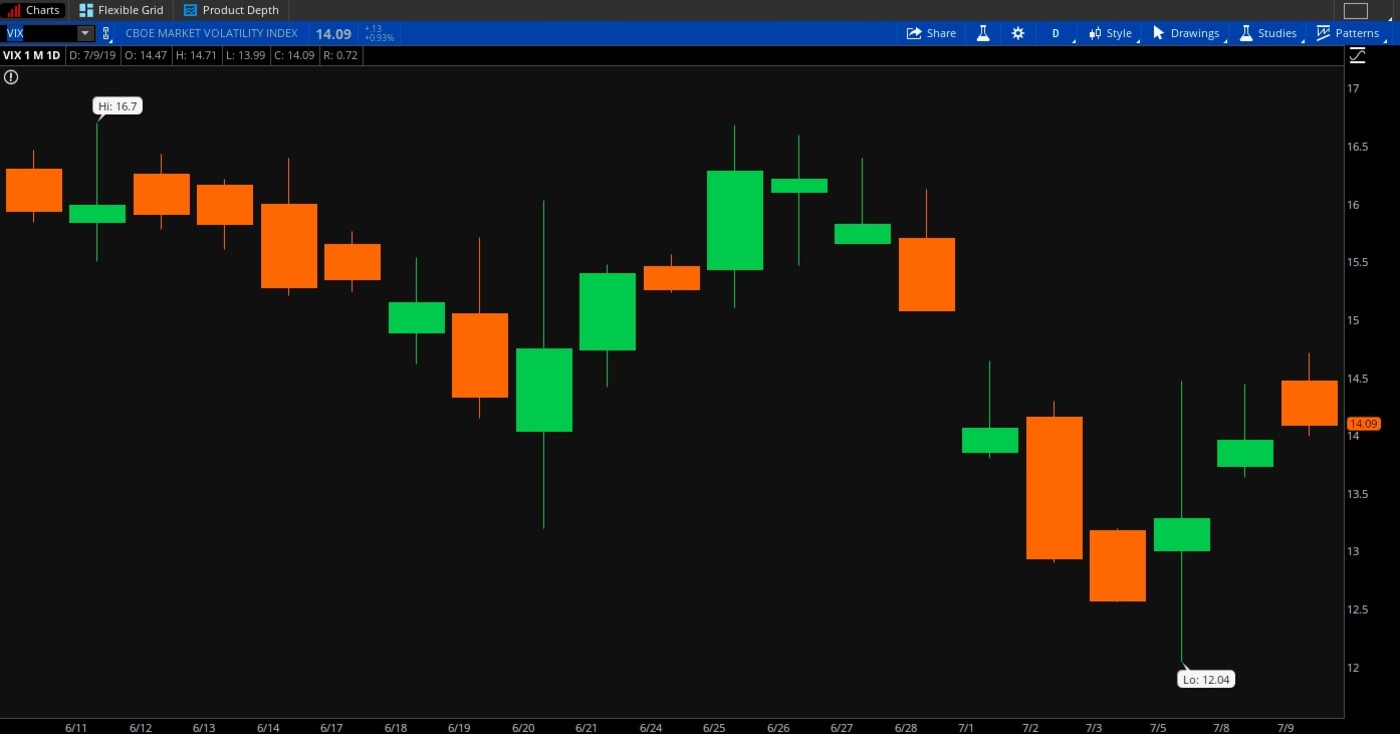

With Powell taking center stage, investors might want to consider a bit more caution than usual going into or out of the markets as he testifies. Quick moves aren’t out of the question if Powell says anything particularly interesting. The CBOE Volatility Index (VIX) jumped about 4% early Wednesday, but then eased quickly after the release of Powell’s prepared remarks.

Earlier in the day, 10-year Treasury note yields rose to 2.1% for the first time in a month, apparently as investors tried to build in some caution in case Powell sounded hawkish. Then as VIX retreated after Powell’s remarks got published, so did the 10-year yield, sinking quickly back to 2.05% about 45 minutes before the opening bell. Gold also bounced back and is now above $1,400 an ounce.

Heading into Powell’s testimony this morning, the futures market puts nearly 96% odds on a quarter-point rate cut at the Fed’s July 30-31 meeting. There’s only a 4% chance of a half-point slice. Just a week ago, the odds had tilted much higher in favor of a half-point move, but last Friday’s positive jobs report and recent remarks from Fed officials appeared to take most of the starch out of that.

Few if anyone expected Powell to push back today against the odds of a July cut. However, it’s a bit surprising to see the testimony so weighted toward the negative, and suggests the economy could be struggling even more than many investors had feared. With earnings season starting next week, the focus could be on whether corporate executives see some of the same concerns as Powell.

With Powell’s testimony focused on low inflation expectations, soft business investment, the trade picture, and weak overseas economies, it sounds pretty similar to the messaging we heard from him after the June Federal Open Market Committee (FOMC) meeting. It looks like the Fed remains poised to keep its hand tightly on the rate lever in coming months. All eyes are likely going to be on Powell for any further insight and his responses to questions once his testimony begins at 10 a.m. ET.

At this point, the futures market puts odds of another rate cut in September at about 60%, according to the CME FedWatch tool. That could be the metric to consider watching most closely tomorrow, because if those odds go up, it might give the stock market another boost.

Next Catalyst After Powell: Earnings Season

Beyond Powell’s testimony, there’s a lot of anticipation this week for Q2 earnings season. Overall earnings are expected to fall, according to forecasting firm FactSet (see more below). Some of the sectors where FactSet expects to see year-over-year earnings declines include Materials, Industrials, Technology, Consumer Discretionary, Consumer Staples and Energy.

The firm also points out that 88 S&P 500 companies have issued negative guidance, the second-highest for a quarter since 2006. Maybe one thing to consider as these negative projections take hold is that over the last several quarters, earnings have often ended up slightly better than many analysts had expected at the start of the season. There’s no way to know if that will be the case this time around, however. We’ll just have to watch the results pour in. Delta (NYSE:DAL) helps kick things off with its Q2 numbers tomorrow morning. That could be worth a look with the Transportation sector lagging lately.

Stocks traded both sides of unchanged Tuesday after Monday’s drop. By the end of the day, two of the three major indices hadn’t made much of a move, but the NASDAQ Composite was an exception. Technology stocks, many of which make their homes in the COMP, had a relatively good day, led by Apple (NASDAQ:AAPL) and some of the semiconductor shares. Financials also performed well as some analysts sound more bullish about big bank earnings next week. Tuesday morning looks like a busy one with several major banks scheduled to report.

Apple turned things around after a poor start to the week, helped Tuesday in part by an analyst note that sounded a bit more cheery about the iPhone demand picture. In fact, all the FAANGs performed well in a pretty decent recovery from Monday’s softness. The FAANGs have generally recovered nicely from their swoon late last year, and Facebook (NASDAQ:FB) leads the way with year-to-date gains of more than 50%. Still, they haven’t moved too much if you compare current prices to a year ago.

Meanwhile, a lot of other market indicators marched mostly in place Tuesday as it looked like people were shy about taking big new positions ahead of Powell’s testimony today and tomorrow. Anyone following the dollar index, 10-year Treasury yields, gold, crude and the CBOE Volatility Index on Tuesday might have had a better time watching paint dry. That started to change early Wednesday as metrics started ticking faster after Powell’s testimony got released. VIX fell back below 14 and crude rose to $59 a barrel.

Stuck In A Trap

One factor that appears to be at play this week (and a lot recently) is a so-called “gamma trap,” and it probably helps explain why the markets seem slow for a long time and then suddenly accelerate one way or the other. In fact, it might have been a factor Tuesday with the market’s late recovery to highs for the day.

The “gamma trap” is a bit complicated to explain, but just keep in mind that gamma refers to the speed at which the price of an option changes. The Wall Street Journal had an interesting article about it yesterday that’s worth a look because it describes pretty well a pattern going on in the markets.

It wouldn’t be all that surprising to see these big moves get more frequent in the next week or two when earnings season starts and the major banks begin reporting their numbers.

Figure 1: RUNNING IN PLACE: The Cboe Volatility Index, or VIX (candlestick) was all over the place earlier this year. That’s changed over the last month, as this chart shows, with VIX staying mainly between 14 and 16.5, a relatively narrow range by historic standards. Data Source: Cboe Global Markets. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Earnings Slowdown Still Seen: With less than a week until earning season hits in a major way, the tidings from forecasting firms aren’t improving. S&P 500 earnings for Q2 are expected to fall 2.6%, FactSet said this week. Research firm CFRA sees a 1.7% decline. That comes after Q1 earnings also fell year-over-year, according to FactSet, setting up a possible “earnings recession” in which the bottom line falls for U.S. companies two quarters in a row, something we haven’t seen in three years. Projected Q2 S&P 500 revenue looks a little more positive, but still doesn’t show much life at an expected growth of 3.8%, FactSet forecasts.

Price Check: Even as Fed Chair Powell comes to Capitol Hill this week to update Congress on issues like economic growth and inflation, the government is scheduled to deliver some key inflation data that might help shape the Fed’s thinking. It starts tomorrow morning with the Consumer Price Index for June. In May, CPI barely budged, rising just 0.1% both for the headline and the core CPI (which strips out volatile energy and food costs). This time around, analysts expect a flat headline CPI and 0.2% growth in core CPI, according to Briefing.com.

As always, investors might end up paying more attention to the year-over-year inflation rise for a broader sense of where prices have gone. In May, year-over-year CPI rose 1.8% and core CPI rose 2%, a slight easing from April. It might be interesting to see if this trend toward lower inflation continued in June, which might be a sign of economic softness. If nothing else, core CPI has been a model of consistency for almost a decade. The 12-month change in core CPI has remained between 1.6% and 2.4% since June 2011, Briefing.com notes. That’s a pretty impressive run, especially if you remember how wild inflation got back in the 1970s and 1980s.

Halfway There: If you’re a long-term investor, this time of year just after the halfway mark is often a good time to consider re-examining your portfolio. A mid-year checkup—something you maybe can find time for this weekend—provides an opportunity to see if your portfolio is still in the best possible shape to track toward meeting your financial goals. These can include priorities such as saving for college, retirement, a vacation home, or putting a child or grandchild through college. If you’ve already established your financial goals and are continuously progressing toward them, the question at mid-year is whether your portfolio still matches your pre-set goals. This year, the market has rallied about 17% since Dec. 31. If you’d allocated a certain proportion of your portfolio to stocks, that percentage might now be swollen beyond where you’d planned thanks to the rally. That could mean it’s time to consider some mid-year rebalancing so that your allocations still match your long-term goal-planning and you’re not taking a more aggressive position in the markets than you’d originally wanted to.

Good Trading