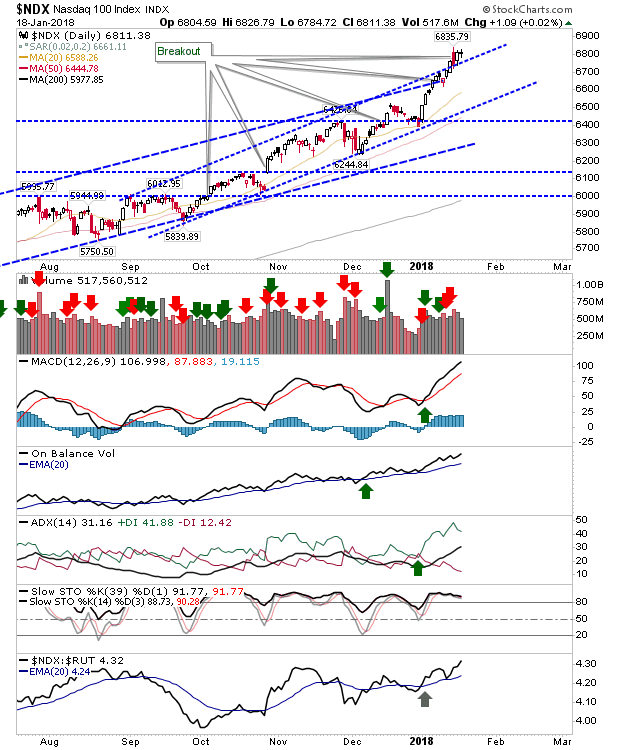

The NASDAQ 100 breakout cleared channel resistance, the fifth significant breakout in four months. All technicals are posting new near-term highs which also meant the short generated on the tag of the rising channel is negated.

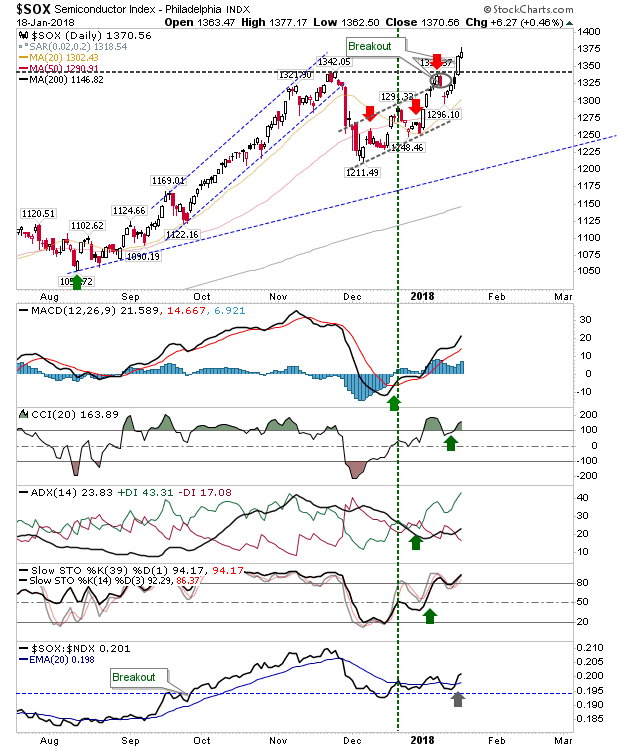

The Semiconductor Index also enjoyed a substantial breakout as short covering drove traders out of their positions. Technicals see an improvement with a relative gain against the NASDAQ 100.

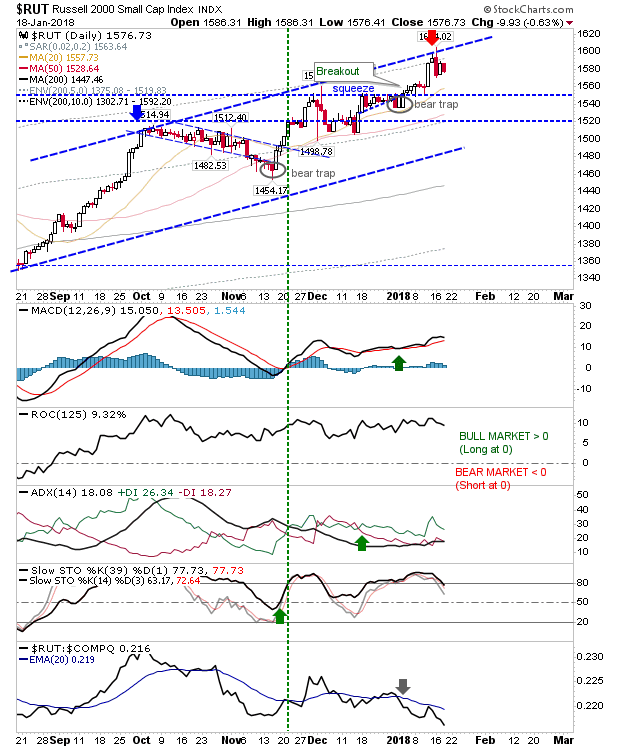

The Russell 2000 is the only index holding to the short-side. Thursday's small losses have condensed into a coil which could spring either way. A move upside may be enough to consider a short cover (based on the assumption for an upside break outside the channel as has already occurred in Large Cap and Tech indices). The short-side outlook remains heavily supported by the acceleration downwards in the relative performance against the NASDAQ and S&P.

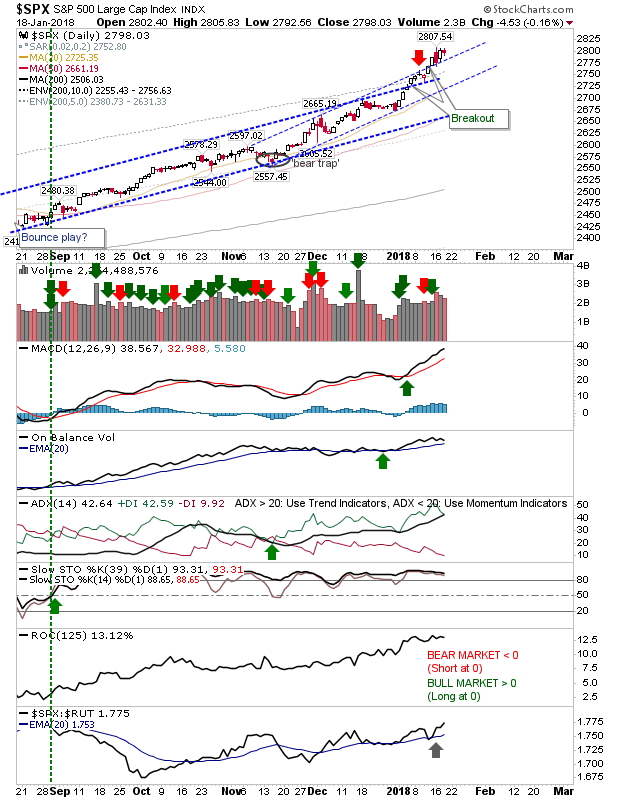

Speaking of the S&P, there was little to add to Thursday's consolidation following its upside channel breakout. My hunch says this is an early stage blowout top but the index is a long way from confirming this (and the run up could be a day traders dream).

For Friday, longs can continue to hold positions in the S&P, Dow and NASDAQ indices. Existing shorts can hold on to their Russell 2000 positions but should have covered the upside break in the Semiconductor and Tech indices. Swing traders can trade the break of the coil in the Russell 2000.